BUYER'S GUIDE

BUYER'S ROADMAP

01

Get Pre-Approved

Meet with a lender to find the right mortgage. Share pre-approval letter with an Agent.

02

Find An Agent

We are local market experts and will work within your budget and wish list.

03

Find your home

We will find you some suitable options and set up showings for you to view.

04

Offer

When you find your dream home, we will submit and offer and negotiate the terms of the contract.

05

Inspection

Complete inspections on the home with a professional. Negotiate any repairs before closing.

06

Appraisal

A professional will determine if the home is worth the price you agreed. A lender cannot lend out more than a home is worth.

07

Pre-Closing

Confirm repairs are completed, do a final walkthrough and transfer funds.

08

Closing

Sign and review all closing documents and receive your key!

YOU'RE HOME

RECEIVE THE LATEST MARKET UPDATES

STEP 01

CHOOSING THE RIGHT AGENT

Your goal is to find a home that meets your needs and budget. As your agent, it’s my goal to make that happen. Here are some ways I back my clients:

- I'll meet with you to understand your goals, so we can create a plan for finding the right home at the right price.

- Buying a home involves a lot of paperwork. Let me navigate the real estate contracts and educate you along the way so you know exactly what you are signing

- Being in the industry comes with expert neighborhood knowledge and insider secrets about properties going on the market before they hit MLS® (Multiple Listing Service).

STEP 02

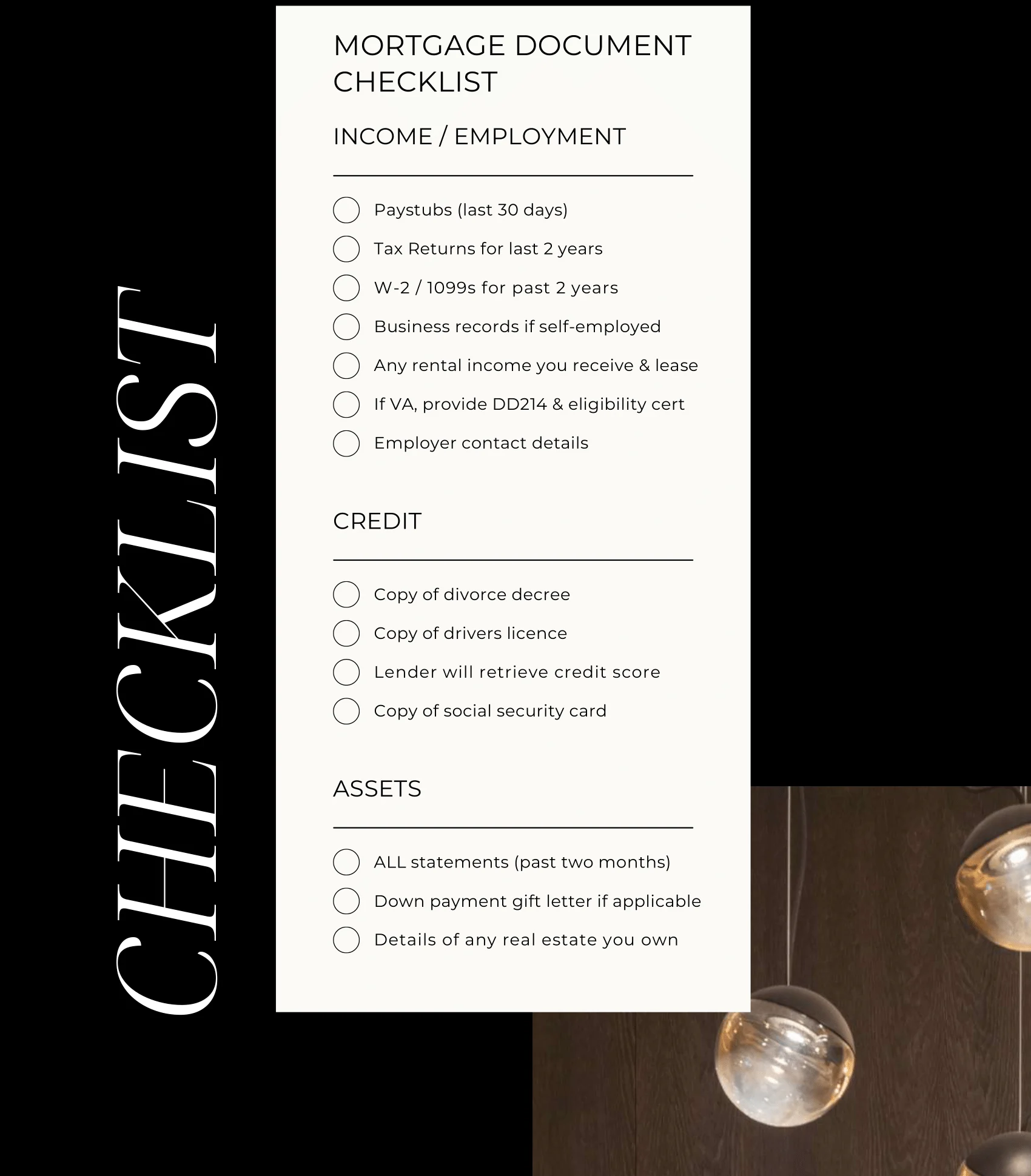

Prepare Finance Records

Before you even start thinking about buying a house, it's important to make sure that your finances are in order and to consider how much you can afford. Mortgage lenders recommend you do not buy a home that is more than 3 - 5 times your annual household income. If you are not purchasing with cash, you will need to find a mortgage lender and get pre-approved.

Credit Report

- Get a copy of your credit report and look over all the information it contains. Your credit score will give you an idea of what kind of loan rates and interest rates you can expect to pay if you do decide to apply for a mortgage.

Costs to Consider

- A Down Payment is typically between 3.5% - 20% of the purchase price.

- Earnest money, or good faith deposit, is a sum of money you put down to demonstrate your seriousness about buying a home. Generally is 1-2% of the purchase price.

- Closing Costs for the buyer run between 2% - 5% of the loan amount.

- A Home Inspection costs $300 to $1500. Depending on the property size and type of inspections ordered.

STEP 03

Get Pre-Approval

A pre-approval is an official document that says that a bank or credit union is willing to lend you a specific amount of money based on your income, assets and liabilities. A pre-approval means that the bank has reviewed your financial information (income and assets) and decided that it's safe for them to give you a loan for at least as much as they have approved for your purchase.

You can start your search knowing how much house you can afford—not just in terms of its price tag but also in terms of monthly payments. You will be able to compare listings with this knowledge at hand and avoid wasting time or money on homes that are outside your price range.

STEP 04

Start Home Shopping

We will set up showings on suitable homes that match your wish list and budget. Here are some tips. Don't worry, we will take care of most things but it's important for you to consider the below.

Check Plumbing and Electrics

- Check kitchen and bathroom plumbing, as well as electrical outlets and light switches for proper operation. Open doors and walk into every room to test their comfort level (no one wants to be surprised by an unexpected closet door).

Note Traffic

- Note traffic on the street and surrounding area. If you commute to work, consider revisiting the area during peak times to get an idea of traffic and travel time.

Take Notes

- You may forget some details when looking at other houses later on in this process, so keep track of them all now as they come up. It’s also a good idea to take pictures.

STEP 05

Make an Offer

Once you’ve found the home of your dreams, it’s time to put things in motion. The next step is to make sure that your offer is competitive. When it comes to making offers on homes here are some things to consider.

Offer Price

- This is how much money you are willing to pay for the home. This can include fees and any other costs associated with buying a home (closing costs). You should also factor in taxes if they aren't included in your purchase price or monthly payments.

An Earnest Deposit

- This is a down payment which shows that you're serious about buying the house; usually around 1 percent of its value.

Offer to Close Quickly

- Offer to close quickly. Try to shorten the inspection period to 10 days or less to speed up the process. Most sellers want to close within 21 days.

The Seller Will Then:

- Accept, reject or make a counter offer. A counter-offer is when the seller offers you different terms. If this happens, you can accept their offer, reject it or negotiate it with our assistance.

Accepted

- If your offer is accepted, you will sign the purchase agreement. Then you are officially under contract!

10 THINGS NOT TO DO WHEN YOUR LOAN IS IN PROCESS

- Don’t buy a car

- Don’t get married or divorced.

- Don’t change professions

- Don’t start your own business

- Don’t go on commission

- Don’t buy ANYTHING! (furniture, appliances, etc.)

- Don’t throw away documents

- Don’t get lazy paying the bills

- Don’t go on vacation

- Don’t shift money around

STEP 06

Get a Home Inspection

A home inspection is a fairly common practice in the real estate industry. We will schedule an inspection with a professional home inspector. It can help you identify issues with the house.

You should use this information to NEGOTIATE with your seller if there are any problems that need attention, especially ones that could be costly to fix. This gives you an opportunity to make sure you don't end up with a home that has structural issues. Be reasonable on smaller issues. If there's minor wear and tear on appliances or carpeting, consider giving it a pass unless there's something seriously wrong with them (like mold on window frames).

STEP 07

Get an Appraisal

Your lender will arrange for an independent appraiser to provide an estimate of the house you are purchasing. The appraiser decides if the cost agreed is a fair price for the property. When purchasing a home, it’s required by most lenders to have an appraisal done to ensure the value of the property is consistent with what you are paying for it. Once approved, expect to receive a letter confirming your loan terms and final rate selection.

STEP 08

Pre-Closing

The pre-closing stage is the period between signing and closing day. It’s time to make sure everything is in order before you move into your new home.

We will complete a title search. This ensures that the seller truly owns the property and that all existing liens, loans or judgments are disclosed.

Here's What You'll Need During This Phase

- Closing Disclosure - Lenders are required to provide you with a closing disclosure, at least three days before closing. This will include your final loan terms and closing costs. You will have three days to review the statement.

- Secure home warranty and suitable home insurance

- Review offer - Your real estate agent will have already reviewed this document with you, but always review it again.

- Review mortgage documents - You'll also want to check out whether or not there are penalties if you miss payments.

- Final walk through - We will do a final walk through the home with you 24 hours before closing to check the property’s condition and make sure any repair work that the seller agreed to make has been done.

STEP 09

Closing Day

Closing will likely be held at the office of the title company, attorney or the lender.

Once all the papers are signed, you’ve secured your mortgage and the closing is officially complete, you’ll receive the keys to the property.

What to Bring

- Government-issued photo ID (x2)

- A certified or cashier’s check in the amount of closing costs due or proof of a wire transfer.

- Your Closing Disclosure

- Proof of your homeowners insurance

Who Will Be There

- A title company representative

- Your agent (Me)

- The seller

- The seller’s agent

- Your loan officer

- Attorneys involved in the transaction

CONGRATULATIONS

YOU ARE OFFICIALLY A HOMEOWNER

LOOKING FOR A HOUSE?

Ready to take the next step in your real estate journey? Whether you're buying, selling, or investing, I'm here to provide expert guidance and support. Contact me today for a free consultation.